Automate the Entire Bank Cheques Lifecycle from Receipt to Reconciliation

AIUN is an enterprise-grade cheque truncation and cheque management platform that replaces manual work with AI and RPA. Process bank cheques faster, reduce errors, stay audit-ready and integrate seamlessly with your ERP.

AIUN fits into your existing ecosystem

AIUN integrates seamlessly with leading ERP platforms such as SAP, Microsoft Dynamics 365 and Oracle, enabling secure and accurate data flow across enterprise systems. It supports file-based, API-driven and workflow-level connectivity in line with organizational IT and security policies. The platform fits easily into existing enterprise architectures without disrupting governance or compliance frameworks. AIUN works across finance, treasury and operations teams to streamline cheque-related processes. This ensures faster processing, improved accuracy and better cross-functional collaboration. Organizations gain end-to-end visibility with audit-ready, scalable financial operations.

The AIUN Solution

AIUN automates cheque processing end-to-end—capturing cheque data, validating it, routing it through approvals, enabling CTS-ready workflows and reconciling transactions back to your ERP with complete traceability.

Built for banks and enterprises handling high cheque volumes.

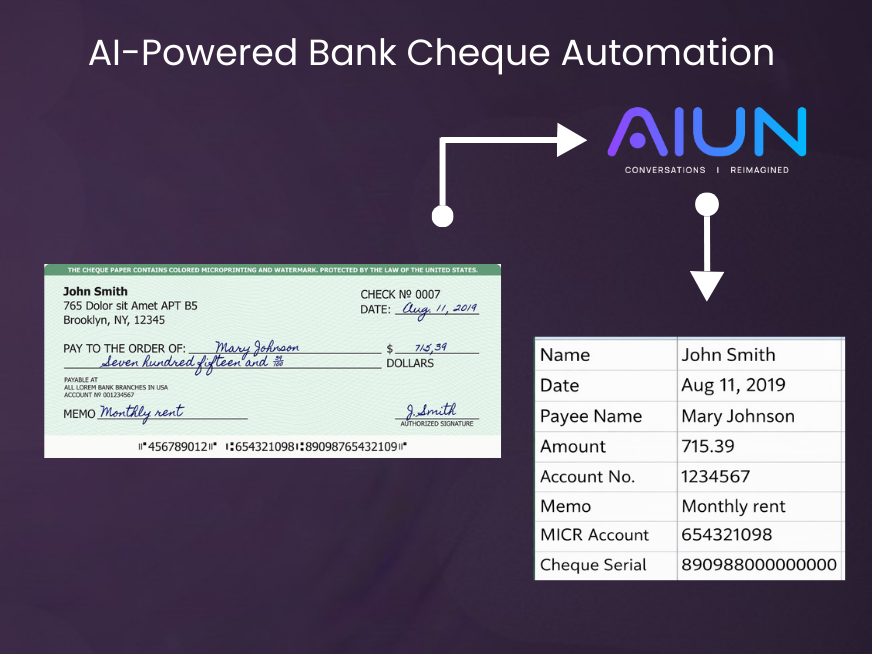

Bank Cheque Capture & Data Extraction

Cheques are securely scanned or uploaded, after which AI extracts key fields and validates data accuracy. The system automatically classifies bank cheque types and routes them through the right workflows for faster, error-free processing.

Validation & Risk Checks

AIUN performs configurable amount and signature checks to ensure accuracy and compliance. It detects duplicate bank cheques and automatically flags exceptions for review and approval, reducing risk and manual intervention.

Workflow Enablement

AIUN enables structured cheque truncation workflows with centralized tracking across branches and departments. Built-in maker-checker controls and configurable approval layers ensure strong governance, accuracy and compliance throughout the process.

Deposit & Credit Tracking

AIUN tracks cheque status from receipt through realization with full visibility at every stage. Automated updates, follow-ups and intelligent alerts for pending, failed or exception cases ensure timely action and faster resolution.

Reconciliation & Reporting

AIUN supports ERP-ready posting and seamless reconciliation with existing finance systems. Real-time dashboards provide clear visibility for operations and finance teams, while audit-ready reports ensure compliance and simplify regulatory reviews.

Exception Handling & Dispute Resolution

Automatically identifies exceptions and routes them through intelligent workflows, enabling faster resolution with full audit trails, approvals and real-time visibility.

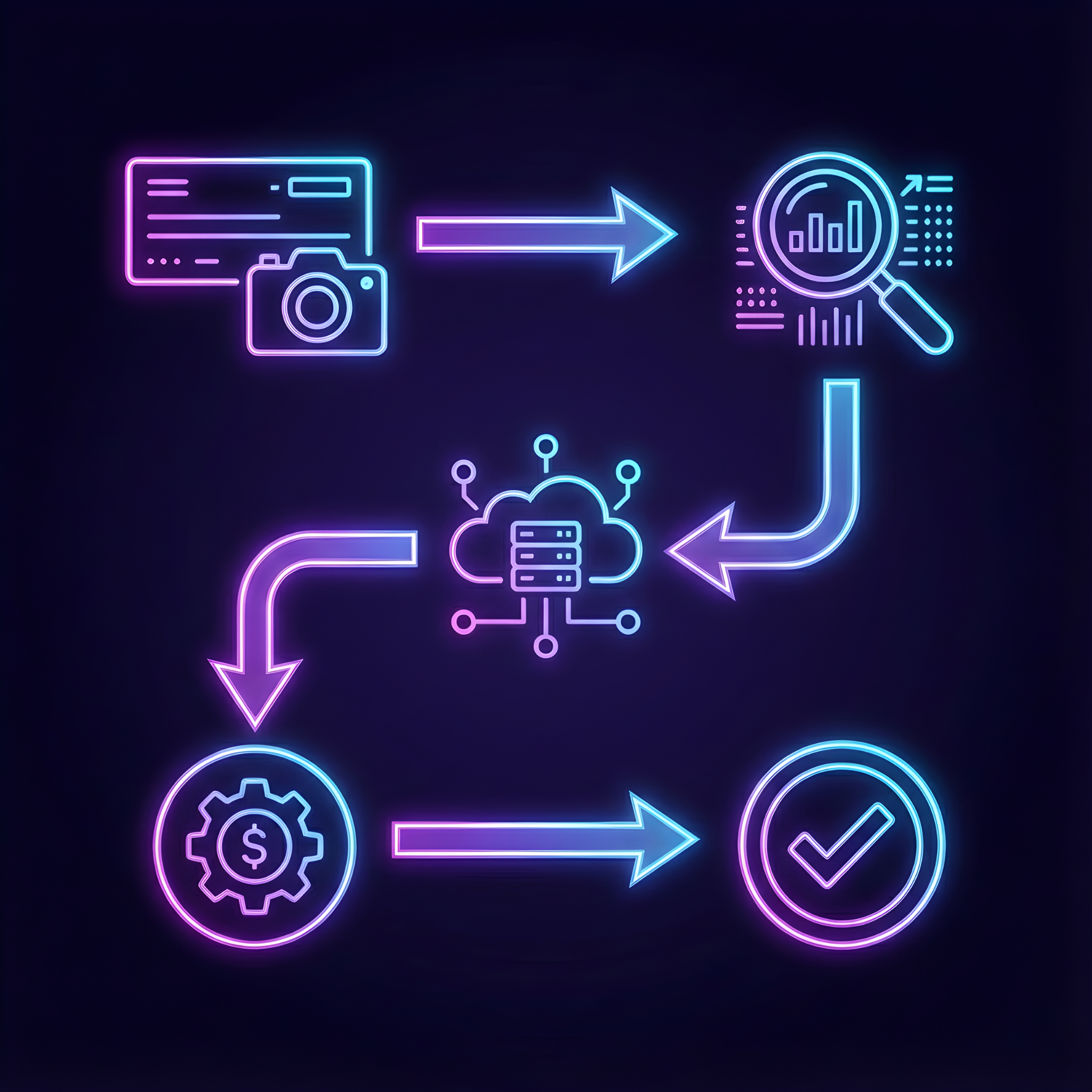

How It Works

Bank Cheques are received through secure scanning or batch uploads, after which AI automatically extracts and validates all cheque data. Based on predefined rules such as amount, location, account and risk, the system intelligently routes each bank cheque through the appropriate workflow. Structured truncation and processing ensure full tracking with complete audit logs. Seamless ERP synchronization and reconciliation help maintain clean books and accelerate financial closure. This automated approach reduces manual effort, improves accuracy and provides end-to-end visibility for finance and operations teams.

Receive & Upload cheques (scan or batch upload)

AI Extracts & Validates cheque data automatically

Workflow Routing based on rules (amount, location, account, risk)

ERP Sync & Reconciliation for clean books and faster closure

Real Business Impact You’ll See from Day One

• Faster cheque processing cycles

• Reduced manual effort and operational cost

• Higher accuracy and fewer exceptions

• Improved compliance posture and audit readiness

• Better visibility into cheque status and cash flow

AIUN is designed to meet enterprise and banking expectations

• Role-based access controls

• Approval workflows and segregation of duties

• End-to-end activity tracking and audit logs

• Secure data handling policies (deployment options available)

The AIUN Solution

AIUN automates cheque processing end-to-end—capturing cheque data, validating it, routing it through approvals, enabling CTS-ready workflows and reconciling transactions back to your ERP with complete traceability.

Built for banks and enterprises handling high cheque volumes.

What AIUN Delivers

Ready to modernize cheque processing?

Move from manual work to automated, secure and compliant cheque operations with AIUN.